![ALTERMES_AVOCATS_BLANC_BLEU[1] ALTERMES AVOCATS BLANC BLEU1](https://www.altermes.fr/wp-content/uploads/2025/06/ALTERMES_AVOCATS_BLANC_BLEU1.png)

LAWYERS

Benefit from a global, operational and cross-functional approach, the fruit of experience acquired in large law firms and international groups.

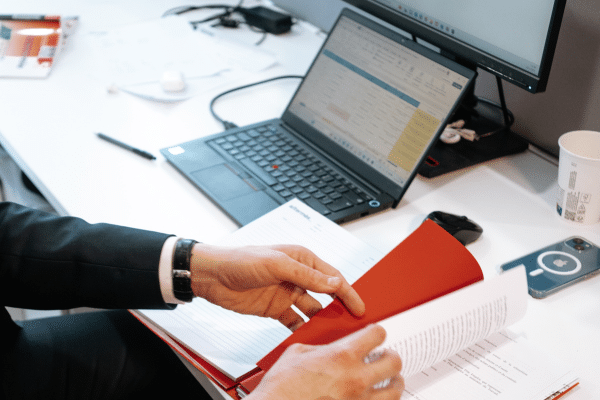

how we support you

Day-to-day operational tax advice

Day-to-day management of operations for the year and their associated tax implications, both current and exceptional

Tax management of changes in Group structures

Internal reorganization, acquisitions/divestitures of businesses or companies

Implementing the new tax rules

Supporting in-house teams in implementing new tax rules and structuring tax reforms

Managing tax audits and disputes

Anticipating and managing tax audits and disputes: internal procedures, reliable audit trail, support in managing audits and disputes

Team training

Training internal teams on corporate tax issues

Day-to-day operational tax advice

- Corporate tax advice on all group development issues

- Tax consolidation (management of integrated tax groups, options, consolidation agreements, overall results)

- Daily tax support for accounting teams

- Analysis of tax treatment of current and exceptional transactions for the year

- Review of the determination of taxable income (estimated, final), and the calculation of individual and aggregate tax expense within tax groups.

- Support in drawing up transfer pricing documentation and the Simplified Transfer Pricing Declaration no. 2257 (matrix of inter-company flows and flow segmentation)

- Active regulatory tax watch by sector

Tax management of changes in Group structures

- Management of external growth operations, company or business disposals, internal reorganizations (mergers, M&A, etc.)

- Assistance with the study and implementation of organization or reorganization schemes and tax strategy in France

- Audit of acquisitions and disposals

- Tax compliance review of legal documentation (merger agreements, deeds of dissolution)

- Declarative schedules

- Review of declarations of cessation of activity

Implementing the new tax rules

- Support in implementing internal VAT processes (definition and implementation of VAT rules, VAT codes, internal AP/AR procedures)

- VAT implications of international flows (“Quick fixes” rule, import VAT/reverse charge, exports, invoice mentions)

- Local taxes

- Electronic invoicing

- Supporting teams in drafting transfer pricing documentation for France and preparing transfer pricing declarations (form 2257)

- Fiscal relay on DPEF and CSRD reporting projects.

Managing tax audits and disputes

- In anticipation of tax audits, assistance to companies in the compliance review phase of their information systems documentation, their reliable annual audit trail reports, including VAT issues .

- Tax compliance following the discovery of significant risks (Corporate Compliance Service)

- Review of the most significant transactions and transfer pricing documentation

- Supporting companies in managing their audits (assistance with technical responses, participation in key meetings with auditors, etc.).

- Support for companies in the post-audit phase (drafting taxpayer observations, appeals and tax litigation).

Team training

At Altermès Avocats, we believe that an organization’s success depends on its teams’ understanding and commitment to tax issues. That’s why we offercustomized training courses tailored to your company’s specific needs.

Our training courses combine tax expertise with a pedagogical approach, whether to reinforce compliance skills, raise awareness of legal obligations or master new regulatory requirements.

Our latest news LAWYERS

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Electronic billing reform is here!

Our integrated team is on hand to support you every step of the way to make your transition a success!

Our partners

Altermes AVOCATS

Perrine ROVEL

Tax lawyer

provel@altermes.fr

+33 1 88 38 09 80

Marie Eve CHAUVIERE

Tax lawyer

mechauviere@altermes.fr

+33 1 88 38 09 80

Contact us

Not a minute to lose

+33 (0)

1 88 38 09 80