Consolidation of accounts is a strategic operation that enables a parent company to present a coherent overall view of its group. Financial statements may be consolidated internally by the Group’s finance department, or externally by an accounting firm with expertise in financial statement consolidation.

1 – The challenges of consolidating accounts

The benefits of consolidation

Consolidating financial statements has several advantages for the parent company and its stakeholders, including :

- it reflects the economic and financial performance of the Group as a whole, by eliminating internal transactions (sales, purchases, dividends, etc.) that have no impact on net income;

- it facilitates financial communication with shareholders, investors, banks, regulatory authorities and the public by providing reliable, comparable and transparent information on the Group’s situation;

- it enables compliance with legal and regulatory accounting and auditing requirements, by conforming to applicable national or international accounting standards (ANC Reg. 2020-01 or IFRS);

The challenges of account consolidation

Consolidating accounts involves a number of challenges for the parent company and its subsidiaries:

- it requires coordination and harmonization between the various Group entities, which may have different information systems, accounting methods, currencies or fiscal years;

- It requirestechnical expertise and a mastery of accounting standards, which can be complex and evolving;

- it entails the financial and human cost of collecting, processing, analyzing and verifying accounting data;

2. Consolidation of financial statements

Consolidation of financial statements

Consolidation of accounts iscompulsory for commercial companies that exclusively or jointly control one or more companies (C. com. art. L 233-16).

Exclusive control results from direct or indirect ownership of the majority of voting rights or the ability to appoint the majority of members of the management bodies of another company.

Joint control results from the fact that at least two companies make decisions in agreement. When a company exclusively or jointly controls an enterprise, it must also include in its scope of consolidation the entities over which it exercises significant influence (C. com. art. L 233-17-2). This influence is presumed when the company holds more than 20% of voting rights.

Exemptions from consolidation

Companies subject to the obligation to consolidate their accounts may, however, be exempted in certain cases (C. com. art. L 233-17), notably :

- if they are part of a small group, i.e. if they do not exceed two of the following three thresholds for two successive financial years: 250 employees, sales of €48 million or total assets of €24 million;

- if they are themselves controlled by a company that includes them in its consolidated accounts ;

- if all their subsidiaries have an insignificant interest, both individually and collectively.

Consolidation methods

The parent company must choose the consolidation method best suited to each entity in the group, depending on the type and degree of control it exercises over it. There are three main consolidation methods (Règl. ANC 2020-01):

- full consolidation, in which all the subsidiary’s assets, liabilities, income and expenses are included. This method applies to subsidiaries controlled exclusively by the parent company;

- proportional consolidation, which consists of including the share of the subsidiary’s assets, liabilities, income and expenses corresponding to the percentage of control exercised by the parent company. This method applies to subsidiaries jointly controlled by the parent company;

- the equity method, which consists of substituting the gross value of the shares held in the subsidiary with the share of the subsidiary’s equity and income corresponding to the percentage of influence exercised by the parent company. This method applies to entities over which the parent company exercises significant influence.

3. The accounts consolidation process

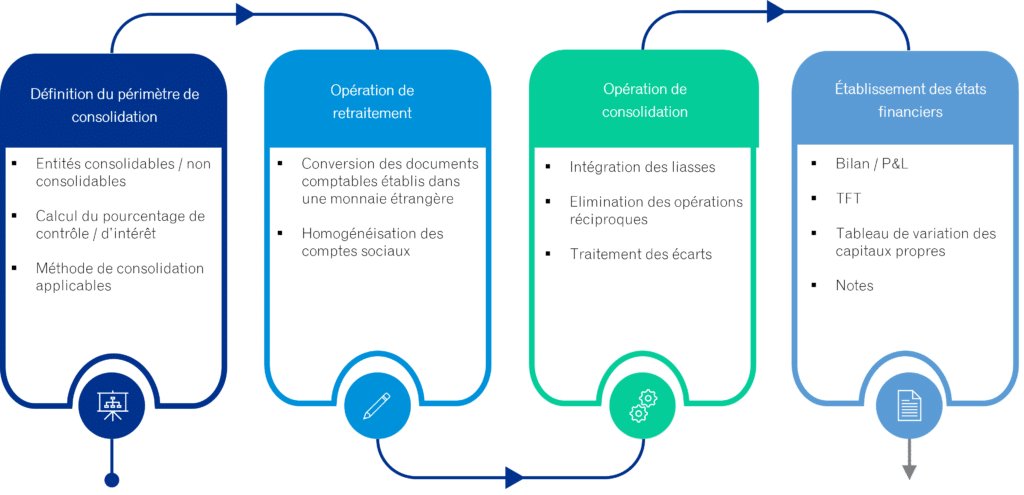

Consolidating accounts is a complex and rigorous process, requiring a number of steps in order to obtain reliable and relevant consolidated financial statements. These steps are as follows:

- determine the scope of consolidation, which covers all entities over which the parent company exercises exclusive, joint or significant control. Consolidatable entities must be identified, along with the nature of control and percentage interests, taking into account any changes that may have occurred during the year (acquisitions, disposals, mergers, etc.);

- make restatements to ensure the consistency and comparability of accounting data for the various Group entities. Accounts expressed in foreign currencies must be translated using the appropriate exchange rates (closing rate for the balance sheet, average rate for the income statement), and exchange rate effects must be eliminated. It is also necessary to standardize the parent company financial statements by applying the same accounting methods and principles between the various companies in the group, in compliance with the accounting standards chosen (ANC Reg. 2020-01 or IFRS);

- carry out consolidation operations, which involve aggregating the financial statements of Group entities according to the consolidation method corresponding to the degree of control exercised by the parent company (full consolidation, proportional consolidation or equity method). Eliminate intercompany transactions, i.e. transactions within the Group that have no impact on consolidated net income (sales, purchases, dividends, etc.). Goodwill also arises from the difference between the price paid to acquire a subsidiary and its net book value remeasured at fair value. These differences break down into two components: the revaluation of identifiable assets and liabilities and goodwill ;

- prepare the consolidated financial statements, which present the assets, financial and economic situation of the Group as a whole. The consolidated financial statements must include the consolidated balance sheet, the consolidated income statement and the notes to the consolidated financial statements. The notes to the consolidated financial statements include a cash flow statement, which shows the Group’s cash inflows and outflows, and a statement of changes in shareholders’ equity, which shows movements affecting the Group’s shareholders’ equity.

❓ Want to find out more about account consolidation? Would you like us to help you consolidate a group of companies? Do you simply want to strengthen your teams to cope with a critical period? Don’t hesitate to contact our expert teams to discuss your needs!

👆 Would you like to find out how we can help an ETI consolidate a group of companies?