Anticipating and successfully making the transition to electronic invoicing

Reform timetable

1ᵉʳ September 2026:

On receipt: all companies must be able to receive electronic invoices.

Invoicing: large and medium-sized companies will have to issue electronic invoices.

September 1ᵉʳ, 2027:

Issuing: extending the obligation to issue electronic invoices to small and medium-sized enterprises (SMEs) and micro-enterprises

Why call on Altermès?

Map your B2B, B2C and international B2B flows and identify applicable use cases

Review and secure your mandatory B2B invoice data

Review and enhance your customer and supplier data repositories

Coordinate the distribution of tasks between your approved platform and your finance/accounting teams

Build your e-reporting file

Not a minute to lose

+33 (0)

1 88 38 09 80

Make an appointment

Map your B2B, B2C and international B2B flows and identify applicable use cases

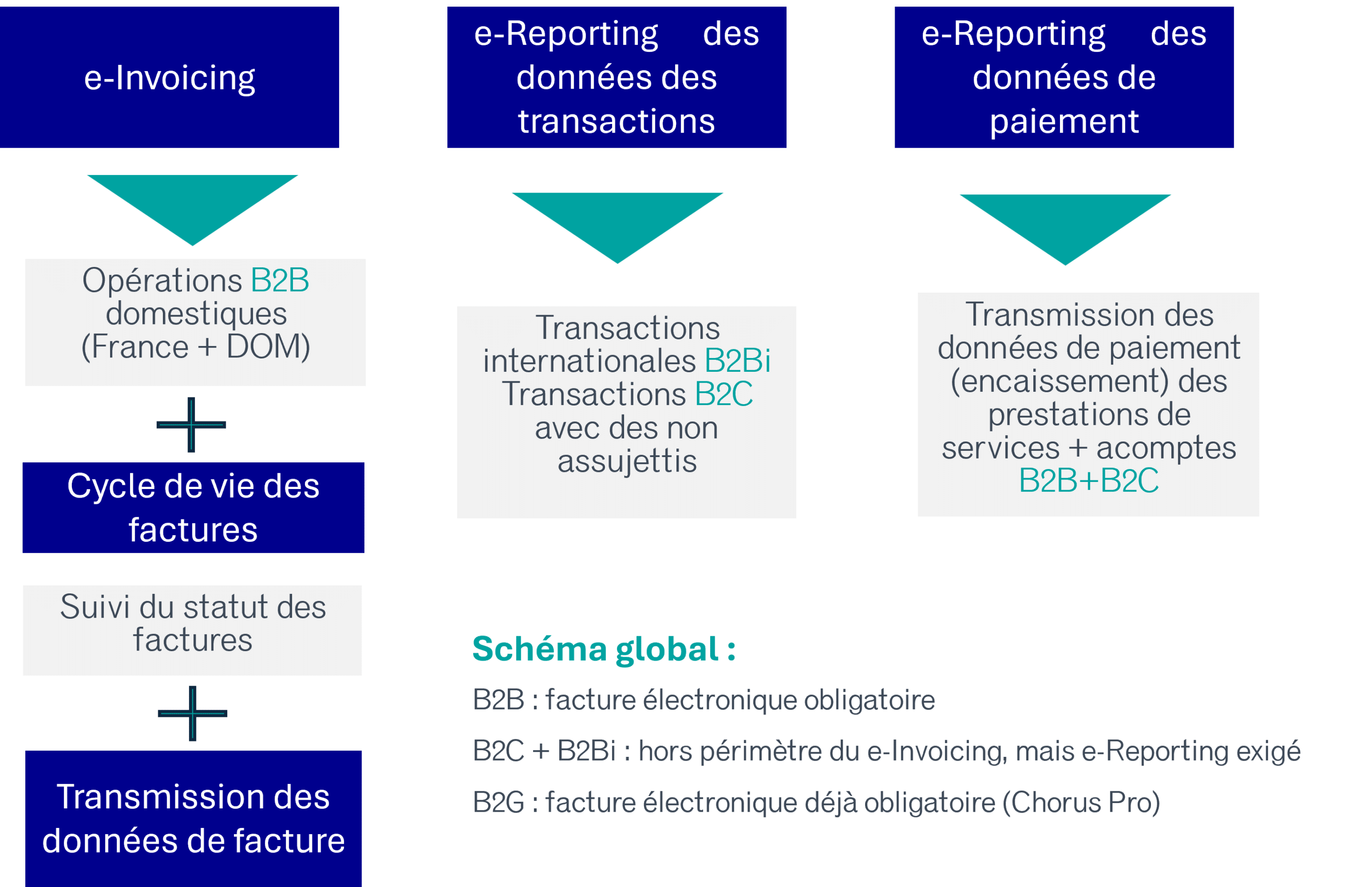

We identify what comes under ” e-Invoicing ” (B2B), ” e-Reporting ” (B2C transactions, B2Bi + reporting of payments/services on collection and down payments) or what is “ out of scope* “, and we ensure that transactions are correctly recorded in the “IS” information systems (internal tools).

We list the use cases applicable in B2B: among the 36 use cases listed in B2B to date, see which ones apply to you.

Review and secure your mandatory B2B invoice data

We check your information systems for the presence of data required by the tax authorities:

-

Presence of 26 mentions at the start of the reform and 8 in the target group

-

As well as the 4 new mandatory statements for invoices issued

Review and enhance your customer and supplier data repositories

We ensure the presence and conformity of expected and mandatory data on invoices in third-party customer databases and their correct allocation in information systems.

We can also enrich your customer databases using our Pappers or CreditSafe connectors.

Coordinate the distribution of tasks between your approved platform and your finance/accounting teams

We work in collaboration with your approved platform to define the areas covered and not covered by it.

We define a RACI matrix to organize the new functions of your finance/accounting team.

Build your e-reporting file

The e-Reporting file for transaction data (article 290 of the CGI)

Beforehand, you need to define who is responsible for constructing the e-Reporting file within your company, and what role your approved platform will play in the process.

In particular, the file must include :

-

B2Bi” transactions, international sales : same data ase-Invoicing

-

B2Bi” international acquisitions (excluding imports): same data ase-Invoicing

-

B2C” transactions : data centralization and daily aggregation of transactions, by category, at SIREN level

AN INTEGRATED TEAM TO SUPPORT YOU

Save time and increase efficiency by drawing on the expertise of our integrated team of tax lawyers, business and financial experts and data architects.

Perrine Rovel

Tax lawyer

Perrine Rovel

provel@altermes.fr

Matthieu Henry d'Ollières

Partner in charge of Consulting

mhenrydollieres@altermes.fr

Pierre-Louis Guiller

Associate

Consulting and Development

pguiller@altermes.fr

Benoit Germond

Associate

Techlead / Data Architect

bgermond@altermes.fr