Context

1st workshop: brainstorming on digitalization avenues

It all started with a simple workshop. Our client, the CFO of an e-commerce site, had taken up his post a few weeks earlier and was facing a number of challenges:

- Need to digitize and modernize existing business and financial tools

- Overworked finance teams

- Departure of an accounting assistant

- Management’s willingness to establish intermediate fences

- Strong business growth expected

The aim of our workshop was to reflect on our customer’s digitalization strategy. To this end, we met with the various parties involved in the accounts preparation process to :

- Map processes and identify risks and controls to be implemented

- Assisting with digitization and the choice of productivity-enhancing solutions

- Assist in improving processes, reducing audit risks and securing financial data

- Propose solutions for centralizing data in a single universe (Datawarehouse or SQL database)

- Set up automated dashboards to meet operational needs

2nd workshop: proposal for a gradual return to bookkeeping

Following the departure of an accounting assistant, it was decided to outsource bookkeeping and use a versatile, experienced team to strengthen financial processes.

Altermès produced an offer to take over the bookkeeping, including several options that could be activated, such as :

- Managing international VAT returns and declarations of trade in goods

- Payroll management

- Managing relations with CACs

- Supplier payment management

- Cost accounting production

- Quarterly closing

We also proposed a gradual takeover scenario, so as not to disrupt the company’s operations.

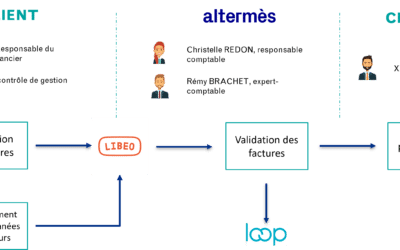

Mission organization

To carry out the mission, our multi-skilled team consists of :

- Matthieu Henry d’Ollières, partner, chartered accountant, for mission supervision

- An Altermès accountant for day-to-day management

- Benoit Germond, techlead for IT technical expertise

- Pierre-Louis Guiller, in charge of development to support technological transformation

Resumption of accounting and financial management

Until now, our customer had been using the following IT solutions:

- Accounting management: SAGE 100

- Merchandise purchasing management: SAGE Co

- Bank payments: SAGE means of payment

In order not to disrupt the current accounting closing, our client’s teams concentrated on closing the 2021 accounts, while Altermès started with the 2022 financial year.

We quickly realized the technical limitations of the SAGE 100 tool compared with our usual Cegid Loop tool, particularly due to the absence of :

- Integrated OCR,

- automatic lettering of accounting entries

- possibility of setting up automatic accounting rules for certain flows

This situation led us to consider switching to Cegid Loop.

We then worked with our technical teams to integrate SAGE Co with LOOP and Spendesk (see below) with LOOP. Unfortunately, connections between software packages are not always straightforward, requiring files to be exported, reprocessed and imported into the new accounting tool.

A good IT culture and/or the availability of a technical team can therefore be essential to the success of an integration project.

Support for Spendesk deployment

Our customer had chosen the Spendesk solution just before we took over. Spendesk has the advantage of being very useful for setting up expense validation circuits and managing virtual cards. Unfortunately, the tool doesn’t automatically integrate with Sage 100 (the customer accounting tool) or Cegid LOOP (the accounting tool mainly used by Altermès).

👆 Don’t hesitate to review our article on tools for digitizing the purchasing process!

Together with the customer, we defined a process for importing purchases made in Spendesk into the SAGE 100 accounting tool, and then into Cegid LOOP.

Taxation

Taxation linked to the online sales sector has undergone a major overhaul following the reform ofe-commerce VAT, which comes into force on July 1, 2021.

Indeed, from July 1, 2021, distance sales made between professionals and private individuals will be taxable in the country of arrival when the seller has made distance sales to European Union countries for an amount exceeding the overall threshold of €10,000. In addition, new rules have been introduced from January1, 2022, to clarify the rules for applying VAT to distance sales, notably via marketplaces.

Against this backdrop, we worked closely with our customer and his teams to implement these new laws. We have also taken over responsibility for foreign VAT returns, previously outsourced to an external firm.

👆 Altermès can assist you with tax issues:

- determining taxable income

- technical assistance during a tax audit

Customer satisfaction

Although we’re still in the process of structuring our accounting management and digitizing our processes, our customer has been very pleased with our involvement and the initial results.

Our initial mission quickly evolved, and we are now working on taking over the accounting and financial activities of certain sister entities. Today, our customer trusts us with his day-to-day accounting needs, allowing him to concentrate on developing his business.

📞 Our teams are available to work with you to improve your financial processes and take over your accounting management!

🔎 Discover our accounting outsourcing offer and focus on growth 🚀

🔎Discover our technological innovation offerings for corporate management and improve your company’s performance! 🚀